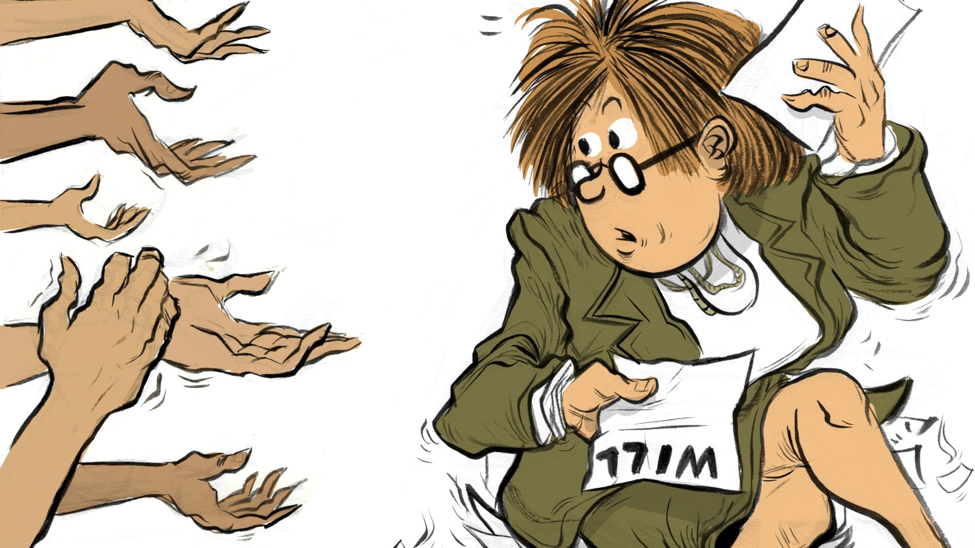

If you die without a will in Texas, you are said to have died “intestate.” In Texas, property is characterized as separate or community. Separate property is that which is owned before marriage or acquired during marriage by gift or inheritance. Damages awarded during marriage from a personal injury lawsuit, except damages representing the loss of earning capacity, also are separate property. Community property is all property, other than separate property, which is acquired by either spouse during marriage. Thus, there can be separate real property, separate personal property, community real property and community personal property. When a person dies without a will, the law determines who are the heirs, and assets are disposed of according to whether they are community or separate property.

If you die without a will in Texas, you are said to have died “intestate.” In Texas, property is characterized as separate or community. Separate property is that which is owned before marriage or acquired during marriage by gift or inheritance. Damages awarded during marriage from a personal injury lawsuit, except damages representing the loss of earning capacity, also are separate property. Community property is all property, other than separate property, which is acquired by either spouse during marriage. Thus, there can be separate real property, separate personal property, community real property and community personal property. When a person dies without a will, the law determines who are the heirs, and assets are disposed of according to whether they are community or separate property.

Distribution of Community Property

Community property, whether real or personal, is distributed in this manner:

1.If the decedent is survived by a spouse and children (or descendants of deceased children):

• If all surviving children and descendants of the deceased spouse are also children or descendants of the surviving spouse, all of the community property passes to the surviving spouse.

• If any surviving child or descendant of the deceased spouse is not also a child or descendant of the surviving spouse, the deceased spouse’s one-half of the community property passes to his or her children (and the descendants of any deceased child), and the surviving spouse retains the one-half of the community property he or she owned prior to the other spouse’s death. However, the surviving spouse has the right under Texas law to use and occupy the homestead during his or her life and may have the right to use or own certain items of personal property that are exempt from creditors’ claims.

2.If the decedent is survived by a spouse but not by any children or descendants, all of the community property passes to the surviving spouse.

3.If the decedent is not survived by a spouse, all property is separate property because the community estate terminates at the death of the first spouse. The following section discusses the intestate distribution of separate property.

Distribution of Separate Property

The distribution of separate property of a person who dies without a will depends on whether it is real or personal property. Separate property is distributed in this manner:

1.If the decedent is survived by a spouse and children (or descendants of deceased children), then subject to the surviving spouse’s rights with respect to the homestead and exempt personal property:

• Separate personal property passes one-third to the spouse and two-thirds to the children (and the descendants of deceased children).

• Separate real property passes to the children (and the descendants of deceased children) subject to a life estate in one-third of the property in favor of the surviving spouse. This means that the surviving spouse is entitled to use one-third of the real property during his or her lifetime, and upon his or her death, the children (or descendants) will have full title to the separate real property of the decedent.

2.If the decedent is survived by a spouse but not by any children or descendants, then subject to the surviving spouse’s rights with respect to the homestead and exempt personal property:

• All separate personal property passes to the spouse.

• Separate real property passes one-half to the spouse and one-half to the decedent’s parents or collateral relatives, such as brothers and sisters or their descendants. If no parents, brothers, sisters, or their descendants survive, then all separate real property passes to the surviving spouse.

3.If only children or their descendants survive, all separate personal and real property passes to the children or their descendants.

4.If both parents survive, but not the spouse or children or children’s descendants, all separate personal and real property passes one-half to each parent.

5.If only one parent and brothers or sisters survive, separate personal and real property passes one-half to the surviving parent and the remaining one-half is divided equally among the brothers and sisters or their descendants. However, if no brothers or sisters or their descendants survive, then all separate property passes to the surviving parent.

6.If no spouse, children or children’s descendants, or parents of the decedent survive, all separate property is divided equally among the decedent’s brothers and sisters or their descendants.

7.If none of the above relatives survive, then all separate property passes generally to the decedent’s grandparents. If no grandparents survive, the law provides for distribution of separate property to more distant relatives.

After the reviewing the rules above to see how your community and separate property would be distributed if you died without a will, would the persons you desire to receive your property actually receive it? If the answer to that question is no, or if you need help applying these rules to your situation, be sure to contact an experienced Estate Planning Attorney.

If you have an individual you trust to handle your estate, you can name that person your “Independent Executor” in your Last Will and Testament. An Independent Executor acts independently of the probate court. Once you pass away, your Will is filed for probate and approximately two weeks later, a hearing can be set. Under oath, your Executor or member of your family states a) the facts concerning your death; b) your residence; c) your family situation; d) the filed document is your Will and has not been revoked; and e) the Executor is qualified to serve.

If you have an individual you trust to handle your estate, you can name that person your “Independent Executor” in your Last Will and Testament. An Independent Executor acts independently of the probate court. Once you pass away, your Will is filed for probate and approximately two weeks later, a hearing can be set. Under oath, your Executor or member of your family states a) the facts concerning your death; b) your residence; c) your family situation; d) the filed document is your Will and has not been revoked; and e) the Executor is qualified to serve.

Losing a loved one is among the most heartbreaking experiences we must face in our lifetime. When an event like this occurs, you understandably have a lot on your mind. Notifying other friends and family members, taking care of funeral arrangements, and trying to cope with your own grief can all feel overwhelming. Add in the additional strain of taking care of the deceased’s affairs, and you may not know where to even begin. The following is a basic checklist for Texans that will help you organize and track the various items that need your attention immediately following the passing of your loved one.

Losing a loved one is among the most heartbreaking experiences we must face in our lifetime. When an event like this occurs, you understandably have a lot on your mind. Notifying other friends and family members, taking care of funeral arrangements, and trying to cope with your own grief can all feel overwhelming. Add in the additional strain of taking care of the deceased’s affairs, and you may not know where to even begin. The following is a basic checklist for Texans that will help you organize and track the various items that need your attention immediately following the passing of your loved one.

If you die without a will in Texas, you are said to have died “intestate.” In Texas, property is characterized as separate or community. Separate property is that which is owned before marriage or acquired during marriage by gift or inheritance. Damages awarded during marriage from a personal injury lawsuit, except damages representing the loss of earning capacity, also are separate property. Community property is all property, other than separate property, which is acquired by either spouse during marriage. Thus, there can be separate real property, separate personal property, community real property and community personal property. When a person dies without a will, the law determines who are the heirs, and assets are disposed of according to whether they are community or separate property.

If you die without a will in Texas, you are said to have died “intestate.” In Texas, property is characterized as separate or community. Separate property is that which is owned before marriage or acquired during marriage by gift or inheritance. Damages awarded during marriage from a personal injury lawsuit, except damages representing the loss of earning capacity, also are separate property. Community property is all property, other than separate property, which is acquired by either spouse during marriage. Thus, there can be separate real property, separate personal property, community real property and community personal property. When a person dies without a will, the law determines who are the heirs, and assets are disposed of according to whether they are community or separate property.

An estate plan is not just a Will and the issues are not just tax issues. Estate planning encompasses every aspect of your life–financial, personal, family–the most private areas for people. Each facet is relevant and infused with the complexity and richness of your life.

An estate plan is not just a Will and the issues are not just tax issues. Estate planning encompasses every aspect of your life–financial, personal, family–the most private areas for people. Each facet is relevant and infused with the complexity and richness of your life.

The marital deduction is one of the most powerful estate planning tools. Any assets passing to a surviving spouse pass tax free at the time the first spouse dies, as long as the surviving spouse is a U.S. citizen. Therefore, if you and your spouse are willing to pass all of your assets to the survivor, no federal estate tax will be due on the first spouse’s death.

The marital deduction is one of the most powerful estate planning tools. Any assets passing to a surviving spouse pass tax free at the time the first spouse dies, as long as the surviving spouse is a U.S. citizen. Therefore, if you and your spouse are willing to pass all of your assets to the survivor, no federal estate tax will be due on the first spouse’s death.

You have two basic choices for transferring your assets on your death: the will, which is the standard method, and the living trust, which is rapidly growing in popularity. If you die without either a will or a living trust, Texas controls the disposition of your property. And settling your estate likely will be more troublesome — and more costly. The primary difference between a will and a living trust is that assets placed in your living trust avoid probate at your death. Neither the will nor the living trust document, in and of itself, reduces estate taxes — though both can be drafted to do this. Whether a will or a living trust is better for you depends on many personal factors. Let’s take a closer look at each vehicle.

You have two basic choices for transferring your assets on your death: the will, which is the standard method, and the living trust, which is rapidly growing in popularity. If you die without either a will or a living trust, Texas controls the disposition of your property. And settling your estate likely will be more troublesome — and more costly. The primary difference between a will and a living trust is that assets placed in your living trust avoid probate at your death. Neither the will nor the living trust document, in and of itself, reduces estate taxes — though both can be drafted to do this. Whether a will or a living trust is better for you depends on many personal factors. Let’s take a closer look at each vehicle.

Since assets in an estate equal to the exemption amount are exempt from estate taxes ($5.49 million per person for decedents dying in 2017), a married couple can use their exemptions to avoid tax on up to double the exemption amount ($10.98 million). An effective way to maximize the advantages of the exemption is to use Portability.

Since assets in an estate equal to the exemption amount are exempt from estate taxes ($5.49 million per person for decedents dying in 2017), a married couple can use their exemptions to avoid tax on up to double the exemption amount ($10.98 million). An effective way to maximize the advantages of the exemption is to use Portability.

If you have minor children, perhaps the most important element of your estate plan doesn’t involve your assets. Rather, it involves who will be your children’s guardian. Of course, the well-being of your children is your priority, but there are some financial issues to consider:

If you have minor children, perhaps the most important element of your estate plan doesn’t involve your assets. Rather, it involves who will be your children’s guardian. Of course, the well-being of your children is your priority, but there are some financial issues to consider:

Whether you choose a will or a living trust, you also need to select someone to administer the disposition of your estate — an executor or personal representative and, if you have a living trust, a trustee. An individual, such as a family member, a friend or a professional advisor, or an institution, such as a bank or trust company, can serve in these capacities. Many people name both an individual and an institution to leverage their collective expertise.

Whether you choose a will or a living trust, you also need to select someone to administer the disposition of your estate — an executor or personal representative and, if you have a living trust, a trustee. An individual, such as a family member, a friend or a professional advisor, or an institution, such as a bank or trust company, can serve in these capacities. Many people name both an individual and an institution to leverage their collective expertise.