While it can be somber to think about our own mortality, I assure you that talking about […]

Your children are important to you. You will spend a good part of your life sacrificing and caring for them. But, what […]

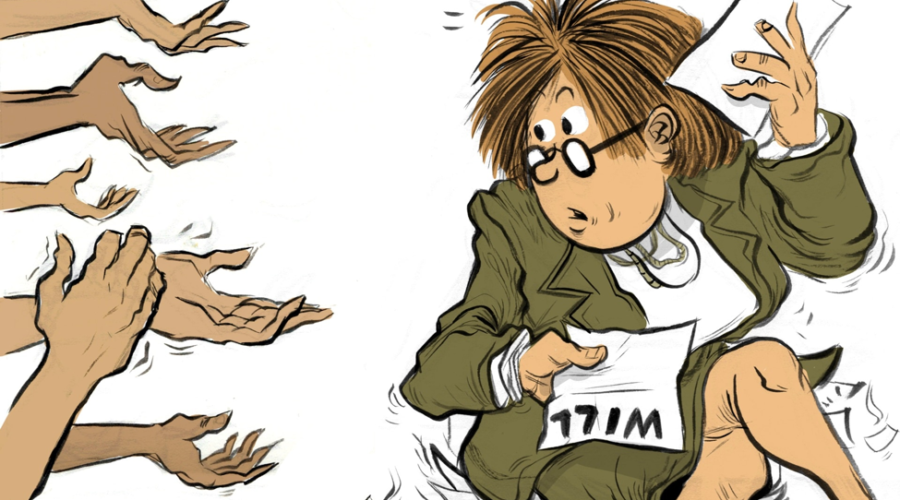

I recently got a call from John who was concerned about his mother, Susan. She had […]

An estate plan is not just a Will and the issues are not just tax issues. Estate planning encompasses every aspect of […]

The marital deduction is one of the most powerful estate planning tools. Any assets passing to a surviving spouse pass tax free […]

You have two basic choices for transferring your assets on your death: the will, which is the standard method, and the living trust, which […]

Since assets in an estate equal to the exemption amount are exempt from estate taxes ($5.49 million per person for decedents dying […]

If you have minor children, perhaps the most important element of your estate plan doesn’t involve your assets. Rather, it involves who […]

Whether you choose a will or a living trust, you also need to select someone to administer the disposition of your estate […]

It’s no secret that April is a month when most Texans are taking care of taxes. But when it comes to estate […]